You might have noticed the shift. Buyers and sellers want simple, flexible, remote closings. But providing these experiences isn’t always easy, especially if your eClosing technology doesn’t integrate or is fragmented.

When closers toggle between multiple systems, tools, and workflows, productivity and the closing experience can take a hit. That’s why choosing the right title closing software for your business is so important.

But where do you start?

A comprehensive guide to eClosing tools

Here’s a comprehensive guide to choosing title closing software that helps avoid common snags so you can improve workflows and create the five-star closing experiences that customers want.

Define your digital closing needs and goals

Finding the best eClosing tools starts with your goals. Defining your objectives upfront ensures you narrow the options based on the most relevant factors. Here are a few considerations:

Identify your biggest pain points. What are your biggest challenges during the closing process? For example, you may struggle with too much paperwork and fragmented processes. As a result, these could become priorities when searching for a solution.

Set eClosing solution goals. Do you want to increase operational efficiency? Reduce costs? Prevent employee burnout? Establish the specific goals you want to achieve so that with every title closing software option, you can ask: Does this option meet our goals?

Account for the size of your business operation. Consider the number of closers you have, how many and the type of transactions you close per month, the number of office locations, and other relevant details—such as travel and mobile notary fees. These details play into the title closing software cost, so gathering the information upfront is helpful when pricing solutions.

With these intentions in mind, you can compare the potential options and determine how well each meets your goals and needs.

Know your must-have eClosing tool features

Do you need remote online notarization (RON), in-person electronic notarization (IPEN), eSign, all of the above, or something else? We recommend all of these must-have eClosing tool features and many others. Here’s our take on what to look for as you evaluate your eClosing solutions.

User experience and product interface

Consider the user experience (UX) of each potential eClosing and title and settlement management software tool. Does it have an intuitive interface, customizable features, and functions that fit your closing workflows? And what if your employees get stuck? Is there real-time support for them?

Accessible design is something else to consider. Align yourself with an eClosing provider familiar with Web Content Accessibility Guidelines (WCAG) reports and designs for accessibility to ensure you can close transactions with anyone, anywhere, and at any time. Examples of accessible design include closed captioning for remote closings, screen reader accessibility, keyboard navigation, high contrast for vision impairment, alt text for images, and more.

Security and compliance

Select an eClosing partner that understands the importance of security and compliance and integrates it deeply into their solutions. The right eClosing solution should comply with your state-level RON legislation using digital certificates to ensure tamper-proof and sealed documents for every transaction and maintain a MISMOⓇ RON certification.

For example, in addition to digital certificates, the Stavvy platform is MISMO certified, maintains a SOC 2 Type 2 report, and leverages various features to ensure compliance and security.

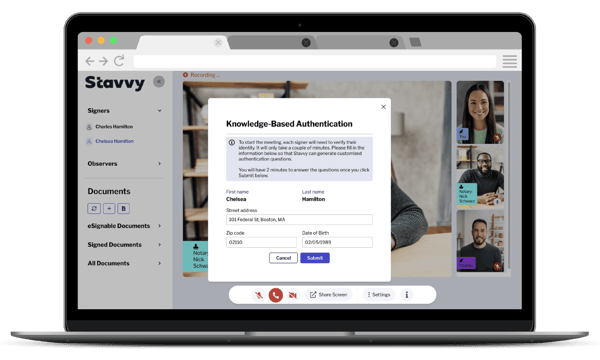

Knowledge-based authentication (KBA) verifies the signer's identity by asking a series of personal questions based on credit reports and public records. The KBA process does not require a credit pull and therefore does not affect a signer’s credit score. Stavvy’s eClosing solution also digitally timestamps and lists participant actions for every task completed during the remote signing process, includes credential analysis, multi-factor authentication, audio/video recordings, and more.

Scalability

Growth. It’s what we all want, right? And that’s why selecting an eClosing tool that can keep up with future advancement and business needs is essential. A few questions to consider:

- Can this eClosing tool keep up with our digital closing plans for the future?

- What’s its capability to adapt to future technology advancements and needs?

- Is the eClosing provider committed to innovation and digital transformation in the real estate industry, or is their attention divided?

- What about commitment to customer support and service? If our team has problems, can they get the help they need?

Stavvy provides extensive product onboarding, training, and support to get users up to speed on the platform and help you scale eClosing when needed. And if you get stuck, we have support staff on standby ready to get you “unstuck” as quickly as possible.

Single platform experience

.png?width=600&height=367&name=stavvy-all-in-one-real-estate-digital-platform%20(2).png)

Using multiple eClosing tools that don’t play nice with one another creates slowdowns and frustration. And nobody wants unexpected delays during a closing. An all-in-one eClosing platform prevents the need to invest in multiple disparate tools, such as one for RON, another for IPEN, and eNote.

For example, Celebration Title consolidated multiple tools into a single platform experience with Stavvy’s eClosing solution. This allowed them to conveniently close buyer and seller-side real estate transactions online with RON and eSign. The Celebration closing team also leverages eSign to send updated settlement statements, closing disclosures, and ancillary documents that don’t require notarization to customers before closing to save additional time and provide a valuable service.

Using an all-in-one eClosing platform saved Celebration Title’s customers $150-$200 in mobile notary fees. Additionally, eClosing transaction turnaround time with the Stavvy platform is more efficient than paper closings.

“By doing it all digitally, we don’t have to mail documents out, physically record a deed, or wait for documents to be mailed back to us from out of state or country. It’s a secure digital transaction, which is a really nice aspect for our customers and internal team. Once the closing documents are signed and notarized, the post-closing team receives the documents immediately and sends the appropriate documentation off for eRecording.”

Celebration Title

Here are a few other features to consider as you shop for title closing software:

- Audiovisual communication. If you’re using an eClosing solution, solid audiovisual communication is necessary because all parties must be clearly seen and heard during the closing. The platform should be as user-friendly as the technology customers already use, such as Apple’s FaceTime.

- Electronic signature. eSignatures ensure you can easily and remotely capture signatures from all parties on closing day, eliminating the need to collect documents in person.

- Digital certifications. Comply with your state-level RON legislation using digital certificates to ensure tamper-proof and sealed documents, providing added security and compliance.

Investigate the eClosing tool’s reputation and support services

Nearly half of customers trust online reviews as much as personal recommendations from family and friends. When looking for reviews, where should you start?

Online software review sites such as Capterra can be a good starting point. For example, when you look up Stavvy, you can read real customer feedback about our eClosing solution. A couple of examples include:

“We had 2 different providers covering 2 different things. Now we have all our needs within one platform.”

“It is a very easy-to-use interface, and clients have had no issues logging on.”

Another resource is case studies to review customer success stories that address your specific pain points and goals.

Here are a few Stavvy examples:

- Consolidate multiple tools and improve efficiency. Read about how Celebration Title Group consolidated multiple tools into a single platform experience.

- Reduce closing times and streamline processes. Read how the Title Team cut residential real estate and mortgage closing times by 50%.

- Achieve five-star customer reviews. Read how Broker’s Title and Closing decreased mail-away volume while continuously earning five-star customer reviews.

And here’s one last consideration when verifying provider reputation: Ensure that the major title insurance underwriters approve the eClosing tool. The Stavvy platform, for example, is approved by all major title insurance underwriters.

Request a personalized demo

Once you have a short list of eClosing options and title settlement software, request demos. During the remote closing platform demo, here are a few important questions to ask:

- Does the solution offer hybrid digital and full eClosing options with eSign, eNote, IPEN, and RON?

- What assistance is provided for training, onboarding, and continued support?

- Can real estate agents, attorneys, and loan officers join the closing meeting?

We compiled our top questions to ask during a RON demo so that you can find the best solution for your business.

And then, of course, you’ll want to dive into pricing details. Many factors impact the cost of an eClosing platform, including the number of transactions, solution features, service and support, and more. So, it’s not always an apples-to-apples comparison, but you want to uncover any additional costs to learn the true price tag of an eClosing solution.

Make an informed decision

With these considerations in mind, you’ll be set to narrow your solution options and get closer to finding the perfect fit. Here’s a quick recap of the steps:

- Define your goals

- Narrow down your must-have eClosing features

- Check out the tool’s reputation and support services

- Schedule product demos

- Gather full pricing details (including any potential extra fees)

And there’s one more thing we’d like to add: Never undervalue the importance of a top-notch customer success team. They can ensure your goals are met, the implementation experience is seamless, and training is available when needed.

Learn more about how the  is taking real estate beyond documents.

is taking real estate beyond documents.

![[Webinar Recap] Advancing Your Digital Default Servicing Strategy](https://blog.stavvy.com/hubfs/advancing-your-digital-default-servicing-strategy-blog-recap.png)