A real estate transaction is considered one of the most important and complicated financial transactions for buyers and sellers. Traditionally on closing day, all involved parties are physically present to ink-sign, witness, and notarize paper closing documents, which can be inconvenient and time-consuming.

So, why, after all these years, are we still relying on an antiquated system of documentation to handle one of life’s most meaningful moments—the real estate transaction?

Throughout this blog, we’ll answer the question: can you close on a house remotely? Plus, we’ll explore the benefits and obstacles of remote real estate closing for buyers, sellers, title companies, realtors, and mortgage lenders.

What is remote closing on real estate?

A real estate closing is the final step in a real estate transaction. It involves the seller transferring property ownership to the buyer and the buyer paying the agreed-upon purchase price. Closing documentation is signed and notarized during the closing, and any outstanding fees and taxes are paid.

How to do a remote closing

While a real estate closing has historically been conducted in person, remote online notarization (RON) has opened the door to the possibility of remote real estate closing. RON allows a notary to perform notarial acts remotely and securely using a compliant RON platform. A RON platform connects all parties via audio-visual technology and enables signers to digitally sign and notarize closing documents, eliminating the need for in-person meetings.

Explore our Complete Guide to RON to learn more about remote online notarization for real estate transactions.

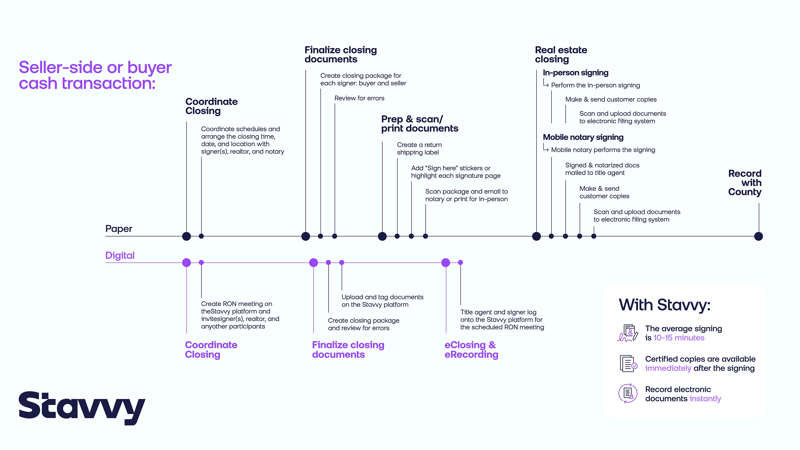

Below is a graph comparing a pen-and-paper real estate closing to a digital closing for seller-side and buyer-side cash transactions and how RON and eSign software, like the Stavvy platform, can offer operational efficiency through industry-specific digital solutions.

Click here to enlarge the infographic.

A remote real estate closing, or a digital closing or eClosing, helps title companies, mortgage lenders, and real estate agents deliver a more convenient closing experience to its customers. In addition, it unlocks the potential to earn more referral business while increasing efficiency, productivity, and even profits. Buyers and sellers also benefit from remote real estate closing, particularly those who may have difficulty taking time off work, require transportation, or have caretaking responsibilities.

What are the benefits of remote closing?

A remote real estate closing can benefit every participant involved in a real estate transaction, including but not limited to title companies, buyers and sellers, mortgage lenders, and real estate agents. Let’s take a closer look at each party and the specific advantages that eClosing can provide.

Remote real estate closing benefits for title companies

There are many advantages to remote real estate closing for title companies, including:

- Improved profitability. A remote real estate closing removes paper, paper processing tasks, and the expenses of printing, mailing, storing, and maintaining records. By leveraging a title industry-specific eClosing platform, remote closing can also help combat time-consuming ‘oopsies’ and redundancies during post-closing. A well-designed platform will ensure that every closing document is complete and every signature line is signed before ending a signing session.

- Increased productivity for title agents and notaries. A remote real estate closing process can reduce manual work leading to more efficient processing and delivery times. With these newfound time savings, title agents, closers, and notaries can focus on other personal and professional priorities, boosting productivity and creating a better work-life balance. In addition, title professionals can close a real estate transaction wherever and whenever it’s convenient, eliminating the end–of–month closing frenzy, extended office hours, and travel.

- Greater closing documentation accuracy. Digital closing helps title companies eliminate the risk of fraud and errors when a transaction is performed on a secure and compliant eClosing platform. By removing paper from the process, remote real estate closing reduces the potential for document loss and damage. Additionally, an eClosing platform can help combat identity fraud with knowledge-based authentication (KBA) and back-end software that can identify if a government-issued ID is authentic.

- A superior customer experience. Title companies can delight customers by presenting them with the flexibility and convenience of reviewing and electronically signing closing documents online. This service eliminates the burden of traveling to and attending a traditional, in-person closing, sourcing a local notary to complete a mail-away transaction, or welcoming an unknown, mobile notary into their home or office.

Check out this infographic blog post to learn more about remote real estate closing benefits for title and settlement agents.

Remote real estate closing benefits for realtors

Real estate agents can benefit from digital closing too. A remote real estate closing allows realtors to represent more buyers and sellers on closing day face-to-face, digitally, instead of traveling to dozens of physical locations in any given month. This efficiency can save realtors time and money, grow their service area, and help them earn more referrals and repeat business.

Remote real estate closing benefits for mortgage brokers

Digital closing can streamline the closing process for mortgage lenders. The most common benefits for lenders include:

- Increased operational efficiency. Digital closing can help lenders experience faster file delivery time and easier collaboration with title companies, investors, and loan servicers. Plus, it can create a more efficient post-closing quality control process.

- Time and cost savings. Mortgage lenders can eliminate the costs of paper, shipping, and storage and accelerate loan delivery, funding, and transaction turnaround times with remote closing. This efficiency alone can help speed up the mortgage lifecycle in a sustainable and scalable manner, leading to further savings.

- An impressive customer experience. Customer service is the name of the game when it comes to successful mortgage lending. A remote real estate closing allows buyers and sellers to review and sign documents whenever and wherever it’s convenient, a welcome option in today’s digital landscape. The flexibility of a digital closing can also reduce stress and anxiety for signers and lead to a quicker real estate transaction, benefiting all.

- Enhanced documentation security. By performing a real estate closing on an eClosing platform, mortgage lenders no longer have to rely on costly, high-risk shipping services, couriers, and email. Digital closing can reduce the potential of fraud, errors, and document loss or damage with a secure and auditable digital transaction.

Remote closing on a house: benefits for buyers and sellers

One of the core benefits of remote closing on a house for buyers and sellers is convenience and flexibility. Buyers and sellers no longer need to coordinate time off from work, child or adult care, or travel long distances to a physical office location. A remote closing on a house can be done from the comfort of signers’ homes, making the process more convenient and less stressful. Secure audio-visual technology through an eClosing platform connects signers digitally with their real estate partners. Buyers and sellers can review, access, and ask questions about closing documents in real-time with trusted title agents and realtors. They can even invite family and friends to help celebrate the milestone or ease closing day jitters.

Obstacles of remote real estate closing

Despite the significant benefits of remote real estate closing, only some states have permanent RON legislation. Therefore, for those interested in remote real estate closing, it’s essential to review local regulations carefully or partner with an eClosing technology provider, like Stavvy, who can ensure regulatory compliance before performing a remote closing.

Additionally, some mortgage lenders still need to implement remote closing strategies. However, in recent years, we’ve seen significant forward momentum for eClosing in the mortgage industry. The United States Department of Veteran Affairs (VA), Fannie Mae, and Ginnie Mae accept digital collateral. Additionally, reputable mortgage companies, like Rate, are investing in eClosing platforms to help transform the industry further and extend its customer-focused approach online. If remote closing is something that you’re interested in, it’s important to advocate for this service to help the real estate industry continue to evolve.

Remote real estate closings are here to stay

Remote real estate closing is possible and offers many benefits to title companies, realtors, buyers and sellers, and mortgage lenders. As an eClosing technology provider explicitly built for the real estate industry, we’re confident that remote real estate closings will become more commonplace over the next few years. There’s no better time to invest in remote real estate closing—presenting a whole new question—what’s holding you back?

Learn more about how the  is taking real estate beyond documents.

is taking real estate beyond documents.

![[Webinar Recap] Advancing Your Digital Default Servicing Strategy](https://blog.stavvy.com/hubfs/advancing-your-digital-default-servicing-strategy-blog-recap.png)