Title agents, real estate attorneys, and mortgage lenders, are you ready to take the next step in your digital closing journey? Are you interested in learning more about eClosing technology and how remote online notarization (RON) can help you close more real estate transactions?

Read on for a step-by-step walkthrough of Stavvy's eClosing solution and important technology tips.

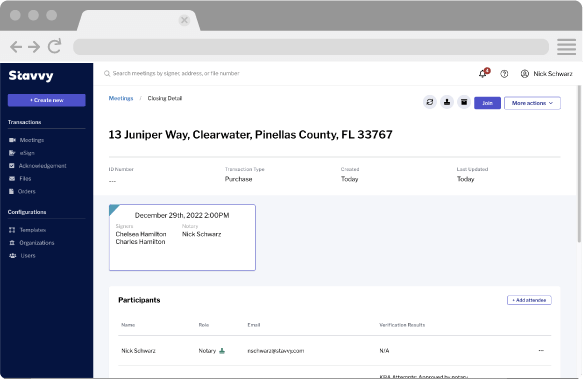

Step #1: Submit and prepare a closing request.

The closing process begins when the lender clears the mortgage to close and initiates a title order request via its loan origination system (LOS) or the Stavvy platform. Stavvy integrates with Encompass® to drive visibility, quality, and efficiency throughout the entire loan process.

eClosing Technology Tip: A LOS integration, like Stavvy's integration with Encompass, makes the title order request accessible within your eClosing solution for a more streamlined experience.

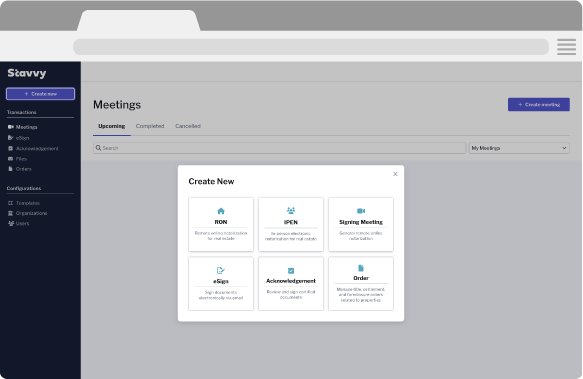

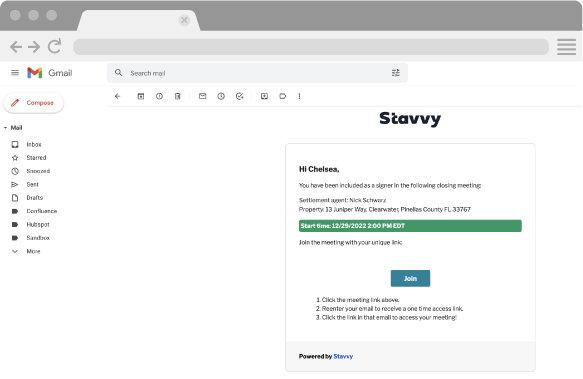

Step #2: Schedule a meeting date and send a secure invitation.

Once the meeting is scheduled on the Stavvy platform, all signing participants receive an automated email notification with the date and time of the signing session, a unique meeting link, and detailed instructions for closing day. The unique URL leads to multi-factor authentication (MFA)—an added layer of protection with a secure access code to join the online closing session.

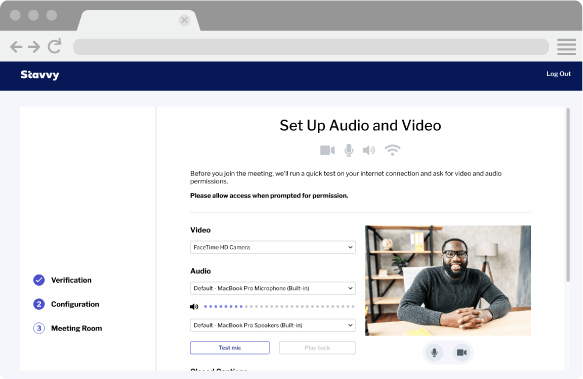

eClosing Technology Tip: On closing day, it is wise to conduct a series of inspections before the session begins to ensure audio and video are working correctly.

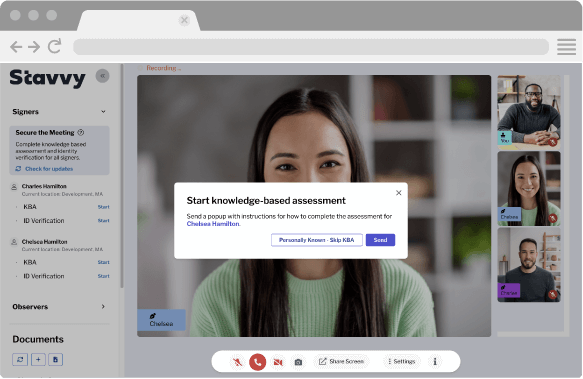

Step #3: The online notary verifies the signer’s identity.

Once the signer joins the meeting, the signer’s identity is verified as per the requirements of the notary’s commissioning state. Once identities have been confirmed, the credential analysis portion of the identification process begins. Signers must provide their cell phone numbers and are prompted to upload a government-issued photo ID. The ID image is sent to the notary for approval within the Stavvy platform. The online notary is responsible for guiding signers through the notarial rules, regulations, and technology time constraints before beginning the signing session.

eClosing Technology Tip: If you’re in the process of vetting eClosing technology providers, you’ll want to make sure the product has knowledge-based authentication (KBA), a series of random questions the signer must answer in two minutes based on public records and credit reports, and credential analysis. Signers are the only people who can see the KBA questions and answers or upload a government-issued ID; completing this step with the online notary live adds immense value and security to the closing.

Step #4: The notary and signer communicate via audio-video technology.

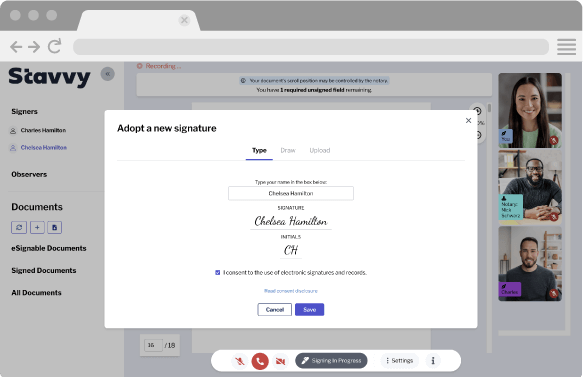

Using the Stavvy platform, the closing meeting host and attendees are lined up on the side of the screen with the mortgage documents in clear view. At this point in the closing, it is recommended for signers and notaries to introduce themselves as another method of identity verification.

eClosing Technology Tip: When looking for an eClosing tool, it is encouraged to find a product with the option to have unlimited attendees in the meeting session. Having the flexibility for limitless attendees, such as loan officers, additional title partners, realtors, attorneys, and parents, helps create a memorable digital closing experience.

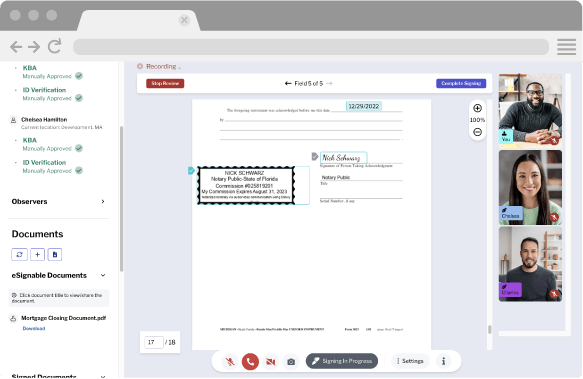

Step #5: Once the signer’s identity is verified, the signer and notary electronically sign documents, and then, the online notary notarizes and finalizes them.

The Stavvy platform uses the digital notary seal (applied by the notary) and embeds the notary’s digital certificate into the electronic document to tamper seal.

Time savings are significant at this point in the process. Signers no longer have to flip through pieces of paper to find flagged sticky notes to sign. Instead, they instantly click the next arrow on-screen and move to the next signature line. Stavvy also provides added compliance safeguards, which you can’t find with paper mortgage closings. Any missed signatures are flagged during the live closing session, saving time and eliminating post-closing lender requests.

Lastly, based on state requirements, Stavvy offers the convenience of using the same digital signature every time. End-users can also navigate, drag, and drop annotations and have the freedom to flip back and forth between digital documents.

eClosing Technology Tip: It can be a cumbersome step for online notaries to set up a notary profile and get their digital certificate set up. Therefore, it is encouraged to look for an eClosing tool that can help guide this process. The Stavvy platform makes this set-up easy and embeds an online notary’s digital certificate into the document instantly, which is self-authenticating and visible to all closing participants.

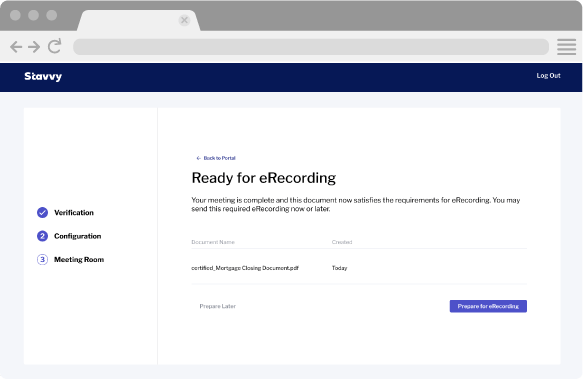

Step #6: The remotely notarized documents are available to the signer for download and securely sent to the lender and title and settlement agency.

At this point, the closing session ends, and certified documents are made available to all participants.

eClosing Technology Tip: When searching for an eClosing tool to support your business, it’s important to think beyond RON and look for a product that can grow with you and your needs, such as eNote and in-person electronic notarization (IPEN).

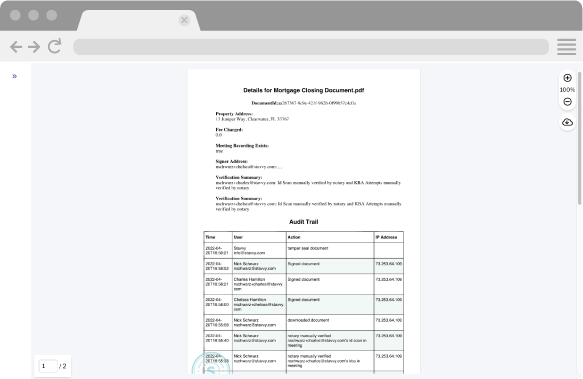

Step #7: An audit trail is available to align with compliance requirements.

The closing is complete, and a digital audit trail is available for review. The audit trail is available as an on-demand PDF and satisfies most compliance queries. The recording and notary journal are also housed in Stavvy for easy access.

eClosing Technology Tip: It’s possible that a regulatory body may ask to review the signing session for compliance reasons post-closing. A digital audit trail breaks down the closing session to the second—starting with when signers enter the closing session to KBA, eSignatures, and applying the notary seal.

Frequently asked questions about remote mortgage closings

What are the key features when comparing RON technology providers for eClosing?

Technology security concerns keep real estate professionals to what they know. Why? Because they often think that technology comes with significant risks. This is just one of the many RON myths circulating the industry today. In the case of digital closing, investing in an eClosing tool with compliant RON, MFA, KBA, and credential analysis is important and ensures that everyone in the closing is who they say they are. For added protection, you’ll also want to look for a solution that offers a digital audit trail and annotation feature. But, with so many eClosing tools available, selecting the right one can be hard.

Learn more: How to choose the right title closing software for your business

What does product onboarding and implementation look like?

A good onboarding process and support team is essential. The key to success is having access to a support team that is willing to walk you through the process and answer your questions. Stavvy offers a full implementation and onboarding team and customer success manager to guide you every step of the way.

How do I know if RON is allowed where I perform closings?

Most Secretary of State websites have a wealth of information and resources you can tap into. We have also compiled a list of RON-approved states on our blog. If you close transactions in multiple states or don’t have the time to source information, you may want to leverage simple technology to streamline the process. The Stavvy platform, for example, has a built-in Eligibility Engine that instantly determines if your closing is eligible for electronic notarization.

Learn more about how the  is taking real estate beyond documents.

is taking real estate beyond documents.

![[Webinar Recap] Advancing Your Digital Default Servicing Strategy](https://blog.stavvy.com/hubfs/advancing-your-digital-default-servicing-strategy-blog-recap.png)