Digital closing statistics: 89% of title companies embrace eClosing and plan to perform more digital transactions in 2024

There is no doubt that digital closing is growing in popularity. Common indicators for digital transformation include an increasing number of states with remote online notarization (RON) legislation and signers actively looking for digital closing experiences. But what is motivating the title industry to go digital, and what role does digital maturity play?

We were curious to find out.

Together with HousingWire, we surveyed 121 title and settlement professionals on digital closing maturity to gain the inside track.

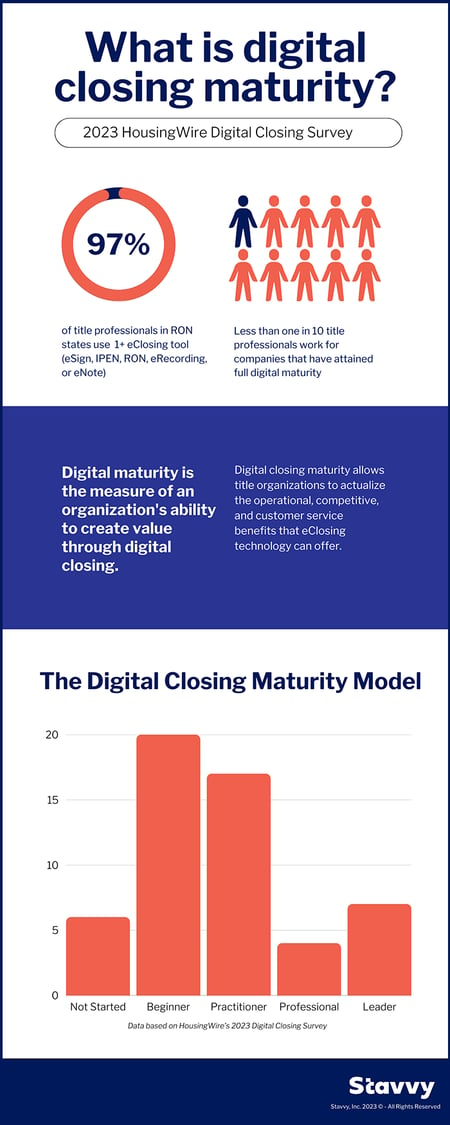

Based on HousingWire’s digital closing survey, 89% of title companies are embracing eClosing, and 97% of title professionals working in RON-approved states leverage one or more eClosing tools today. However, only 7% of respondents work for a digitally mature organization, demonstrating a significant opportunity for eClosing in the industry.

What is digital closing maturity, and why does it matter?

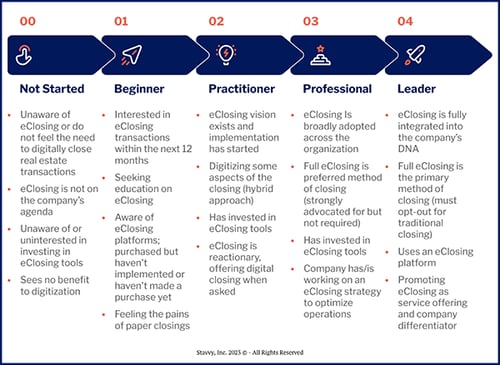

Digital closing maturity is the measure of an organization's ability to create value through eClosing. The first step to digital transformation for title companies is learning about digital closing options and investing in eClosing tools. Organizations must then commit to attaining digital closing maturity to achieve long-term, quantifiable advantages, like cost and time savings, competitive advantage, and new business opportunities. To help guide title companies along their digital closing path, we developed a five-phase Digital Closing Maturity Model outlining the general characteristics and traits of organizations with varying degrees of maturity.

Additional digital closing statistics from HousingWire’s survey include:

- 60% of title professionals shared that customers, lenders, and real estate agents ask for eClosing by name

- 55% of those surveyed found that time savings were the primary driver for eClosing

- 52% of survey respondents cited cost savings as central to why they’re offering or considering eClosing at their organization

- About 49% of those surveyed cited “competitive advantage” as the reason they are interested in moving to or have already added eClosing to their service offerings

- 31% of survey respondents cited internal advocacy as a reason they are moving toward eClosing

- 64% of surveyed title professionals shared that their organization promotes digital closing to attract new customers and retain existing ones

The state of digital closing in the title industry

According to the HousingWire survey, 97% of respondents located in states where RON is available are using one or more of the following eClosing tools—eSign, in-person electronic notarization (IPEN), RON, eRecording, or eNote.

When asked about a digital closing strategy, 28% of survey respondents answered, “We love eClosing and are always strategizing on how to optimize it.” Eighteen percent (18%) are “working on an eClosing strategy but haven't finished,” and only 9% said an eClosing strategy is unimportant to them.

Additionally, surveyed respondents expressed a positive outlook for digitally closing real estate transactions in the future. With 100% of Phase 4 companies expecting to close 90% or more of transactions digitally in the next 12 months.

While every title and settlement organization has different motivators for performing eClosing, there are other noteworthy advantages to a digital approach, such as enhanced security.

Real estate fraud prevention continues to be an important topic in the title industry. RON can help combat threats like seller impersonation due to remote closings' enhanced safety and identity verification measures, particularly when compared to in-person procedures. Stavvy General Counsel Brooke Adams reminds the title industry that “RON should still be regarded as the safest option available due to the advanced verification tools and safeguards that eClosing platforms incorporate. These measures far exceed the security provided by a notary checking someone’s ID during an in-person notarization.”

Title and settlement companies that invest in eClosing can also often rely on technology with robust security measures, including encryption and secure access controls, reducing the risk of documents being lost, stolen, or tampered with and thus, creating safer transactions for everyone involved. Many eClosing platforms, including Stavvy, can also provide real-time tracking of the closing, allowing all parties to see the status of documents and tasks via a digital audit trail and video recordings. Automated checks throughout the digital closing process can ensure that all necessary fields are filled out correctly, reducing the risk of errors and post-closing mishaps.

Despite eClosing advantages, obstacles remain

According to anecdotal evidence gathered by HousingWire from interviews with surveyed title professionals, some barriers to eClosing include RON availability, general hesitancy around eClosing technology, failure of lenders to adopt eClosing tools, a lack of understanding by signers, and document security concerns.

There’s been positive momentum for eClosing in the mortgage industry in recent years. The United States Department of Veterans Affairs (VA), Fannie Mae, and Ginnie Mae now accept digital collateral, propelling digital transformation forward. Some mortgage companies have followed suit by launching digital closing initiatives and entertaining conversations with eClosing technology providers and title partners, including Rate. Title professionals can further this progress by continuing discussions and identifying partnership opportunities to make digital experiences and technology the new industry standard.

Safeguarding closing documents is also easier with the right eClosing solution. When paper documents are sent through fax machines, scanned and attached to emails, or shipped, the possibility of personal data being stolen increases. Digital closing with a secure eClosing platform, like Stavvy, can help mitigate these risks.

The HousingWire survey highlights a clear trend: title companies are gravitating towards eClosing, and digital maturity can drive success

A vast majority of survey respondents are either already digitally closing transactions or are strategizing implementation. The cited benefits range from convenience, speed, and cost savings to enhanced security measures.

With title companies committed to eClosing and mortgage companies and other real estate partners following suit the future of the industry is digital. If you’re ready to fuel growth at your title company, you don’t have to go at it alone.

Title and settlement organizations play a critical role in digital transformation across the entire real estate ecosystem, and your continued engagement, collaboration, and commitment to digital closing maturity will be instrumental in making eClosing the new standard for real estate transactions.

Learn more about how the  is taking real estate beyond documents.

is taking real estate beyond documents.

![[Webinar Recap] Advancing Your Digital Default Servicing Strategy](https://blog.stavvy.com/hubfs/advancing-your-digital-default-servicing-strategy-blog-recap.png)